XRP Price Prediction: Path to $3.00 Amid Bullish Technical and Fundamental Alignment

#XRP

- Technical Breakout Potential: XRP trading above key support with MACD showing bullish momentum and Bollinger Bands indicating room for upward movement toward $3.20

- Institutional Adoption Growth: XRP treasury holdings surged to $11.5 billion while new ETF filings and institutional interest provide fundamental support

- Market Sentiment Recovery: Strong rebound from recent volatility with 8% recovery and $30 billion flowing back into the market after trade-war impacts

XRP Price Prediction

XRP Technical Analysis Shows Bullish Momentum Building

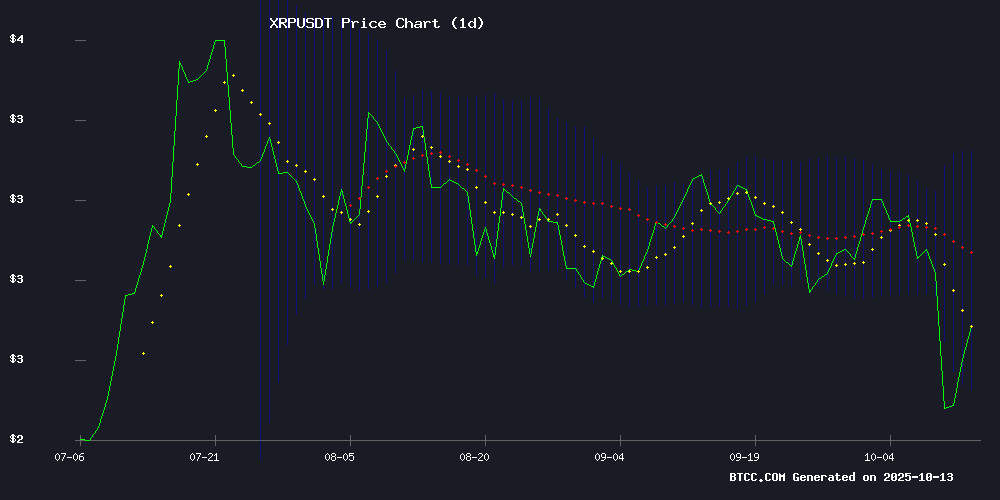

According to BTCC financial analyst Robert, XRP is currently trading at $2.62, showing promising technical signals for potential upward movement. The price sits above the lower Bollinger Band at $2.43, indicating support is holding strong. While the current price remains below the 20-day moving average of $2.81, the MACD indicator shows positive momentum with a reading of 0.0301, suggesting bullish pressure is building.

Robert notes that the key resistance level to watch is the middle Bollinger Band at $2.81, with the upper band at $3.20 representing a significant technical target. The convergence of these technical factors suggests XRP has room for appreciation toward the $3.00 level.

Positive Market Sentiment Fuels XRP Optimism

BTCC financial analyst Robert points to multiple positive catalysts driving XRP sentiment. Recent headlines highlight XRP's surge toward $3.65, successful rebounds from key support levels, and growing institutional adoption with treasury holdings reaching $11.5 billion. The emergence of new XRP ETF filings and a $200K security challenge for the XRPL lending protocol demonstrate continued ecosystem development.

Robert emphasizes that the combination of technical recovery patterns and fundamental growth drivers creates a favorable environment for XRP to test higher price levels, supporting the technical prediction of potential movement toward $3.00.

Factors Influencing XRP's Price

XRP Surges Towards $3.65 Amid Renewed Bullish Momentum

XRP has rebounded sharply from recent lows, gaining 8.76% in the past 24 hours to trade at $2.60. The rally comes with a $15.73 billion trading volume, signaling renewed market confidence. Analysts draw parallels to 2017's capitulation pattern, which preceded a six-week surge—suggesting history may repeat.

Key resistance levels at $2.75 and $3.65 now serve as critical thresholds for the next upward move. Crypto analyst CRYPTOWZRD notes XRP/BTC pair strength as particularly telling, with the asset demonstrating resilience despite broader market volatility.

XRP Price Rebounds from Key Gann Support Amid Market Volatility

XRP has staged a notable recovery, climbing to $2.58 after a flash crash triggered by geopolitical tensions. The rebound follows a 42% drop earlier in the week, with institutional buyers stepping in to push trading volume past $617 million.

Technical analysts highlight the defense of a critical Gann support level near $2 as a bullish signal. ChartNerdTA notes this zone has historically marked turning points for XRP, with some projections now targeting a breakout toward $15–$27.

The recovery coincides with broader market stabilization, particularly between 14:00–17:00 GMT when aggressive dip-buying emerged. Over $30 billion in market capitalization was restored during the rebound.

Ripple Launches $200K Security Challenge for XRPL Lending Protocol

Ripple has partnered with blockchain security platform Immunefi to conduct a stress test of its upcoming XRPL Lending Protocol. The $200,000 "Attackathon" invites white-hat hackers to identify vulnerabilities before the protocol's launch, reflecting the heightened risks associated with DeFi lending platforms.

The initiative underscores Ripple's strategic push into decentralized finance. Critical vulnerabilities discovered during the October 27-November 29 testing window will qualify for bounties from the rewards pool. "This reinforces our mission to protect Web3's most critical ecosystems," said Immunefi CEO Mitchell Amador.

As lending protocols remain prime targets for exploits, the hackathon serves both as a security audit and confidence-building measure. The XRPL Lending Protocol represents a cornerstone of Ripple's expanding DeFi roadmap, with its success potentially influencing institutional adoption of XRP-powered financial infrastructure.

XRP Breakout Looms as Bulls Charge Toward $2.70

XRP is showing strong bullish momentum, with trading volume surging 24.23% to $10.25 billion amid a 9.26% price rally. The asset now faces a critical test at the $2.70 resistance level, where analysts identify a substantial sell wall.

Despite weekly losses of 12.14%, the daily recovery suggests shifting market dynamics. Technical indicators show weakening bearish pressure, with RSI and MACD readings hinting at potential trend reversal.

Market participants remain cautiously optimistic as XRP trades at $2.62, balancing short-term opportunities against broader market volatility. The coming sessions will prove decisive for the cryptocurrency's near-term trajectory.

XRP Bulls Target $2.60 Resistance Amid Strong Recovery

XRP has surged past $2.50, fueled by renewed bullish momentum after finding solid support above $2.25. The rally mirrors broader gains across major cryptocurrencies, with traders now eyeing a critical test at the $2.60 resistance level.

Technical charts reveal a bearish trend line forming near $2.66 on hourly timeframes—a decisive break above this barrier could propel XRP toward $2.80. The token currently trades below its 100-hour moving average, a historical resistance point that may determine the sustainability of this rebound.

Fibonacci retracement levels add credence to the upward move, with XRP already clearing the 61.8% threshold. Market participants await confirmation of whether institutional flows or retail FOMO will drive the next leg higher.

XRP-Linked Project Tundra's Presale Nears $1.2M Amid Strong Investor Interest

Tundra's Frozen Fortune presale has secured $1.2 million across six phases, attracting 11,612 participants to its dual-token model. The project's Phase 6 offers TUNDRA-S at $0.1 with 14% bonuses, while promising future listings at $2.5 for TUNDRA-S and $1.25 for TUNDRA-X.

Audits by Cyberscope, Solidproof and FreshCoins validate the protocol's hybrid approach combining DeFi yields with traditional finance rigor. The organic growth underscores market appetite for structured crypto projects with transparent accounting.

XRP ETF Surge Signals Bullish Momentum Amid SEC Filings

XRP is poised for a potential breakthrough as anticipation builds for the first U.S. spot exchange-traded fund (ETF) tied to the cryptocurrency. Recent filings with the Securities and Exchange Commission suggest an XRP spot ETF may soon materialize, marking a pivotal moment for the digital asset market.

Investor interest has surged as multiple issuers updated regulatory filings, signaling readiness for institutional participation. Key details like ticker symbols—typically added in the final stages of ETF preparation—have emerged, reinforcing expectations of an imminent launch. This momentum follows a wave of filings dating back to August, underscoring sustained efforts by major firms to secure regulatory approval.

Nate Geraci of The ETF Institute highlighted the flurry of S-1 amendments, noting filings from Bitwise, Franklin, and Grayscale among others. The inclusion of ticker symbols suggests these funds are nearing completion. Grayscale's move to convert its XRP Trust into a spot ETF further underscores the coordinated push toward institutional adoption.

XRP Treasury Holdings Surge to $11.5B as Institutional Adoption Grows

XRP's resurgence in 2025 has sparked significant institutional interest, with corporate treasuries now holding $11.5 billion worth of the cryptocurrency. The digital asset traded near $2.63 this year—its strongest performance since 2017—though still below its all-time high.

Japan's SBI Holdings leads corporate adoption with $10.4 billion in XRP reserves, integrating the token into its cross-border remittance services through subsidiary SBI Remit. Singapore's Trident Digital plans a $500 million XRP treasury for staking and ecosystem participation, while Webus International Ltd aims to establish a $300 million reserve for global payments.

XRP Rebounds to $2.55 After 40% Flash Crash, Eyes Key Resistance

XRP has clawed back to $2.55 following a violent 40% plunge to $1.25 during weekend market turmoil, now testing a critical resistance level that historically dictated its 2025 price trajectory. The token's rapid recovery—its steepest intraday rebound this year—signals strong accumulation at support levels.

Whale activity suggests institutional confidence, with on-chain data revealing large holders moving XRP off exchanges during the dip. Momentum builds as ETF progress and improved liquidity could fuel a breakout toward June's $3.60 peak.

XRP Rebounds 8% as $30B Flows Back In After Trade-War Rout

XRP surged 8.5% in a 24-hour window, reclaiming $30 billion in market capitalization after last week's tariff-induced sell-off. The rally from $2.37 to $2.58 was fueled by institutional demand, marking one of the year's highest-volume sessions. Traders aggressively bought the dip ahead of key macroeconomic developments.

The recovery follows a 50% collapse triggered by U.S. trade policy announcements, which initially erased $19 billion from crypto markets. Analysts now eye a potential weekly close above $3.12—a record that would cement XRP's strongest performance since launch. Despite broad risk-off sentiment in traditional markets, crypto desks reported selective institutional inflows into XRP.

Technical indicators show an ascending channel forming between $2.37 support and $2.59 resistance. A sustained breakout could target $2.70-$2.75, while failure to hold $2.50 may trigger a retracement to $2.42. Momentum remains bullish, with institutional activity driving each upward leg.

New XRP ETF Filing Targets CME Benchmark Amid Market Turmoil

The race to launch the first spot XRP exchange-traded fund intensifies as major asset managers, including 21Shares, Bitwise, and Grayscale, submit amended filings to the SEC. The proposals come during a broader crypto market downturn, signaling institutional confidence in XRP's long-term viability.

21Shares' filing reveals a passive ETF structure tracking the CME CF XRP-Dollar Reference Rate, a benchmark favored by institutional investors. The fund will custody assets with Coinbase and list on Cboe BZX Exchange, providing traditional market access to XRP exposure without leverage or derivatives.

Market observers note the timing reflects growing demand for regulated crypto products despite current volatility. The SEC's decision on these filings could set precedents for how regulators view XRP's regulatory status following Ripple's partial legal victory last year.

Will XRP Price Hit 3?

Based on current technical indicators and market sentiment, XRP shows strong potential to reach $3.00. The cryptocurrency is currently trading at $2.62, with several factors supporting upward movement:

| Indicator | Current Value | Significance |

|---|---|---|

| Price | $2.62 | 28% below $3.00 target |

| 20-day MA | $2.81 | Key resistance level |

| Upper Bollinger Band | $3.20 | Technical target above $3.00 |

| MACD | 0.0301 | Bullish momentum building |

According to BTCC financial analyst Robert, the combination of positive technical signals, strong institutional adoption with $11.5 billion in treasury holdings, and multiple ETF filings creates a favorable environment for XRP to test the $3.00 level in the near term.